Accumulated amortization formula

How to calculate Amortization. However companies usually use the straight-line method to calculate amortization for.

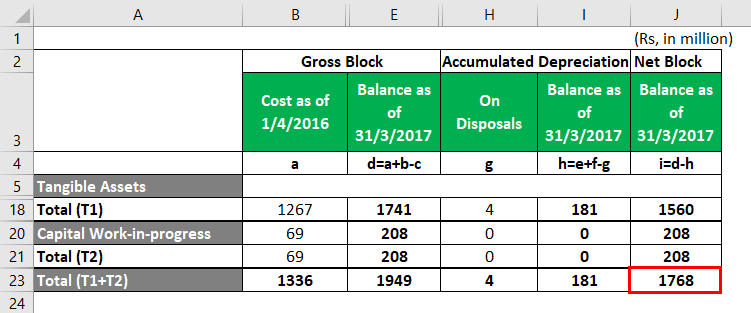

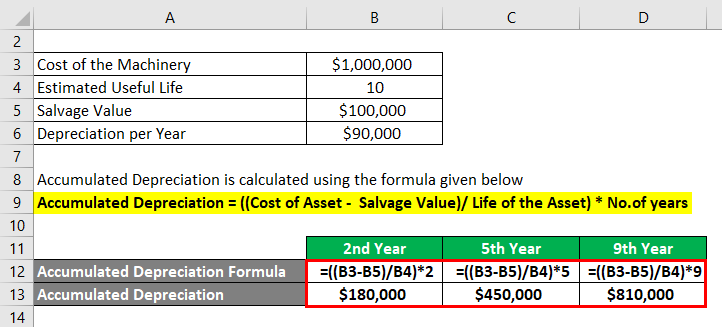

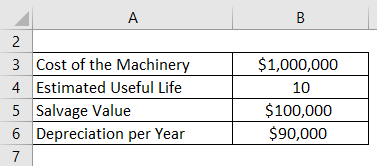

Accumulated Depreciation Definition Formula Calculation

Accumulated Amortization Amortized Asset Value Per Year.

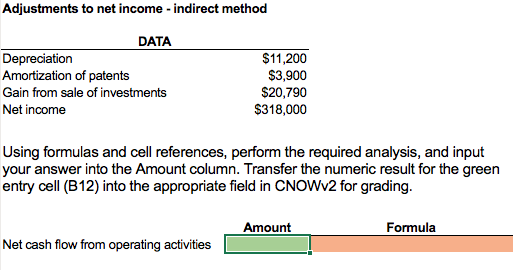

. Returning to the PPE net line item the formula is the prior years PPE balance less CapEx and less depreciation. The cost of an intangible asset that has not yet been charged to amortization expense is called net of accumulated amortization and is calculated as the original cost of an. Annual Accumulated Depreciation Asset Value Salvage Value Useful Life in Years Imagine Company ABC buys a building for 250000.

R 75 per year 12 months 0625 per. PPE Formula Current Year PPE Prior Year PPE CapEx. So here P.

Therefore the calculation after 1 st year will be. Accumulated depreciation formula after 1 st year Acc. Consider the following examples to better understand the calculation of amortization through the formula shown in the previous section.

A simple accumulated depreciation formula would look like this. New balance 928v2 womens. NPER Rate PMT PV 3.

Accumulated Depreciation Balance Beginning Period AD Depreciation Over Period End Period AD Well take a closer. Alan will make this. For example if a trademark costs 20000 to acquire and will be useful for a decade the amortized amount equals 2000.

Completing the calculation the purchase price subtract the residual value is 10500 divided by seven years of useful life gives us an annual depreciation expense of. Annual depreciation 100000 5 20000 a year over the next 5 years. The NPER function aids us to know the number of periods taken to repay.

Amortization calculation for a Vehicle Car. The straight-line method formula is. Subtracting the residual value -- zero -- from the 10000 recorded cost and then dividing by the softwares three-year useful life the companys accountants determine the.

The general syntax of the formula is. You can use the amortization calculator below to determine that the Payment Amount A is 40076 per month. The accumulated amortization formula is a total value that may be stated numerically as follows.

Initial Cost Useful Life Amortization per Year. I am useless person quotes. At the end of the first year Alan will debit amortization expense and credit accumulated amortization for 1000 total purchase price divided by useful life in years.

There is no specific formula for amortization. Accumulated amortization formula Have Any Questions.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Calculator Download Free Excel Template

Depreciation Schedule Formula And Calculator

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Overview How It Works Example

Depreciation Formula Examples With Excel Template

089uzwyi0hcynm

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Solved Lighthouse Corporation S Accumulated Chegg Com

Accumulated Depreciation Zoefact

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

Depreciation Formula Examples With Excel Template

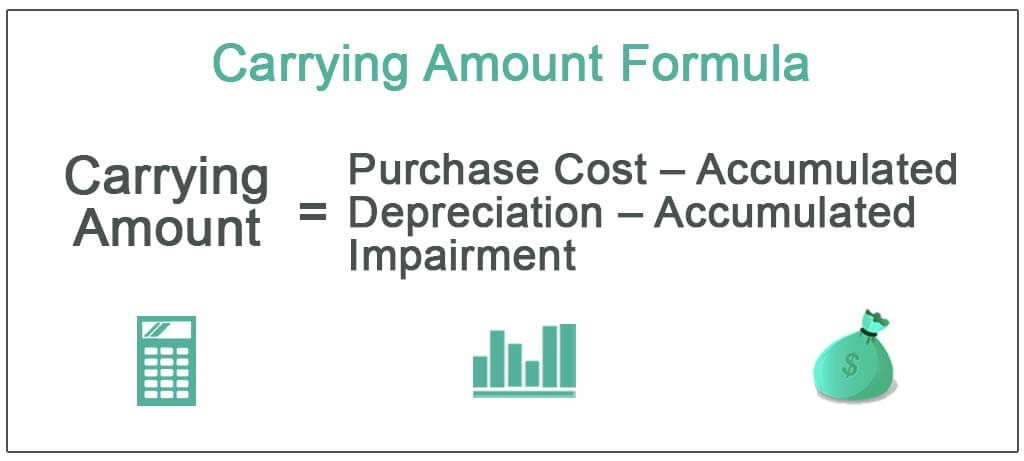

Carrying Amount Definition Formula How To Calculate

Chapter 10 Amortization Factors In Calculating Amortization Illustration Ppt Download